»If I didn’t own my building, my business would be closed a long time ago.» Patricia

Philadelphia, PA – In the diverse landscape of Philadelphia, insurance premiums vary significantly across neighborhoods, reflecting unique risk factors and socio-economic conditions. After asking many residents from different backgrounds and living in different zip codes, the results show they all are affected by paying higher insurance premiums. There are unequal dynamics of insurance pricing in three distinct contexts: higher insurance for economically disadvantaged neighborhoods, neighborhoods with a high crime risk, and the considerations for middle-class residents.

Neighborhoods with High Risk of Crime

Areas with a pronounced risk of crime experience a direct impact on insurance pricing. Insurers closely evaluate crime rates, including incidents of theft, vandalism, and violence, when calculating premiums for homeowners and businesses. The increased probability of filing a claim in these neighborhoods increases insurance costs.

Law enforcement strategies, community policing, and local initiatives play pivotal roles in reducing crime rates and, subsequently, insurance premiums. As neighborhoods work towards enhancing security measures, insurance pricing may respond positively over time, but for now, there is no hope for that to happen soon. Kensington residents are one of the populations extremely impacted by being denied insurance or paying high premiums.

For almost three months, many policyholders who are insured shared their experiences. On October 2nd, 2023, Kensington Corridor Trust’s Executive Director, Adriana Abizadeh, and Jasmin Velez, Lead Community Organizer, said: «We applied for 17 insurances and were denied except for one.

The one who accepted us was the one that we already had, and their only condition to continue providing business insurance to the organization was to raise the price. We went from paying $22,000 to now paying $49,000 per year. They told us the reason for the increase in the price was a crime rise in the area. “If this happened to us, imagine what would happen to our local businesses. It is why we will connect you with some of the business owners from our corridor.»

The first stop was at a local holistic store. His owner did not want me to share his name, but he was willing to share his experience. «I have been here with my business for almost 30 years, and all the insurances are so high. If I didn’t own my building, I am sure my business would have gone a long time ago. After COVID everything went up too.»

Higher Insurance for economically disadvantaged Neighborhoods

In economically disadvantaged neighborhoods, residents often face higher insurance premiums. The increased vulnerability to property crime, limited access to quality healthcare, and a higher chance of accidents can contribute to elevated insurance costs. Insurers factor in these elevated risks when determining premiums and work toward mitigating potential claims in these areas.

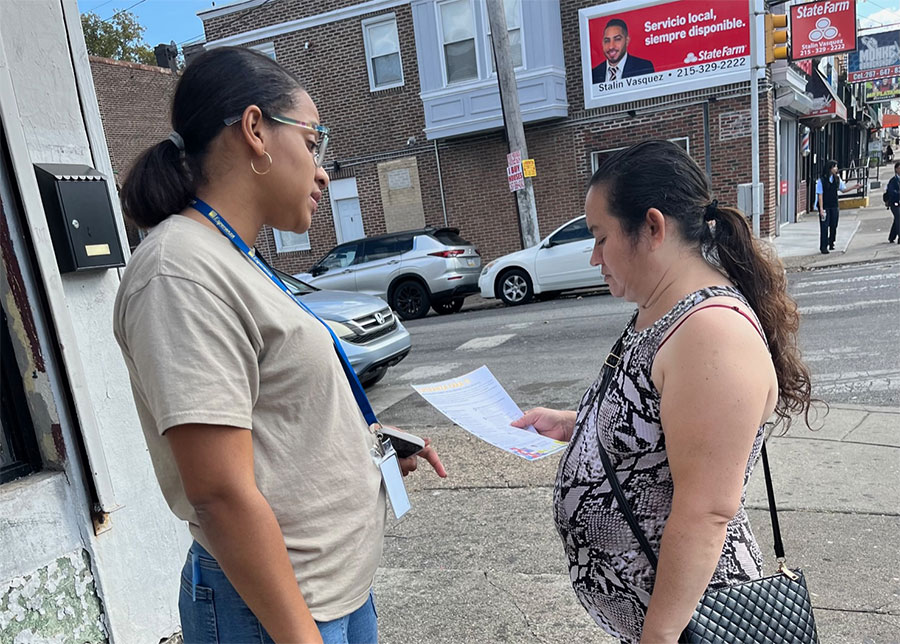

Darlenys Melo, Community Business Associate at Esperanza Housing and Economy Development, led a tour to meet business owners from the N 5th Street corridor. The purpose was to ask about their different insurances, including their business and their rates.

Patricia Arcila, Latin Fashion’s owner, said: «All the insurance goes up. This week, I looked at my car insurance, which went up by 6%; the homeowner insurance for my townhouse went up by 14%, and the one for my building usually increases from $2,000 to $3,000 per year. I called the insurance carrier, and their explanation about raising the prices is inflation. They always have an excuse to increase their rates.

I tried to move to another insurance company, which is more expensive. If I didn’t own my building, my business would be closed a long time ago, I really pay attention to my finances, and I am teaching my son how to do it, too.»

Martha Gee from Titis’s Learning Academy said: «It’s true that everything is going up. The mortgage increased two to three times from last year to this one. All the insurance went up and is affecting a lot of low-income families. The impact is radical. I have been doing research for the last couple of years, and I can see the big changes.»

Middle-Class Considerations

Middle-class neighborhoods in Philadelphia, while generally enjoying more favorable insurance rates compared to high-risk or economically disadvantaged areas, are not immune to fluctuations in premiums.

Sheila Munoz, One of Boleros Events’ business owners, said: «After COVID, everything went up. The car insurance is high. In the whole nation, the insurance companies raise the prices. One of the reasons the business insurance went up is due to a lot of robberies. It does not matter if you live in a dangerous area or a nice area; the insurance is going up.»

Christian said: » I checked my car insurance statement, and it went up by $30. I called the insurance company to ask the reason why the rate was higher, and their answer was because of inflation.»

The inequities in pricing of insurances begs the question, is it fair to pay more and get less?

Why is poverty so expensive? Who regulates these systems, and are they willing to improve them? Lili Daliessio is the Community Information Manager at Esperanza Housing and Economic Development.